How To Do Payroll Accounting Yourself

Content

Heather is a staff writer and payroll specialist with several years of experience working directly with small business owners. Her expertise allows her to deliver the best answers to your questions about payroll.

The following chart details the top-paying states for payroll accountants. While the ideal professional skills depend on the tasks involved in the job, payroll accountants typically have a similar skillset. Due to the nature of their work with numbers, accountants need strong mathematical skills. They also need computer skills to work with the different software and applications required.

Vacation And Sick Time

This Act establishes a tax that transfers money from workers to aged retirees . The social purpose of the tax is to provide a modest income stream to the beneficiaries. Another component of the Act is the Medicare/Medicaid tax, which provides support for health care costs incurred by retirees . A payroll deduction plan is when an employer withholds money from an employee’s paycheck, most commonly for employee benefits and taxes. Once you have taken out pre-tax deductions, the remaining pay is taxed. The FICA tax rate is 7.65%—1.45% for Medicare and 6.2% for Social Security taxes. Other tax rates will be determined by Federal, state, or local laws and your employee’s W-4.

What’s the difference between payroll and accounting?

is that accounting is (accounting) the development and use of a system for recording and analyzing the financial transactions and financial status of a business or other organization while payroll is a list of employees who receive salary or wages, together with the amounts due to each.

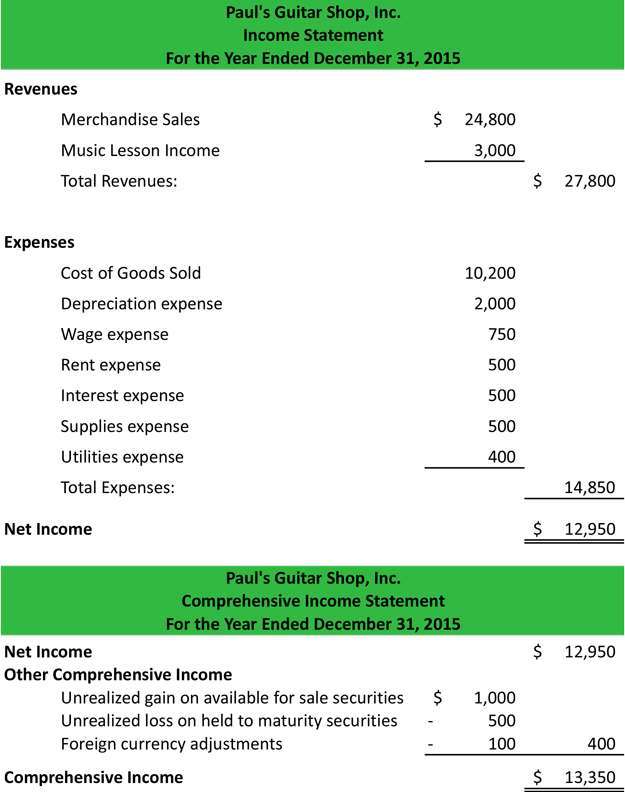

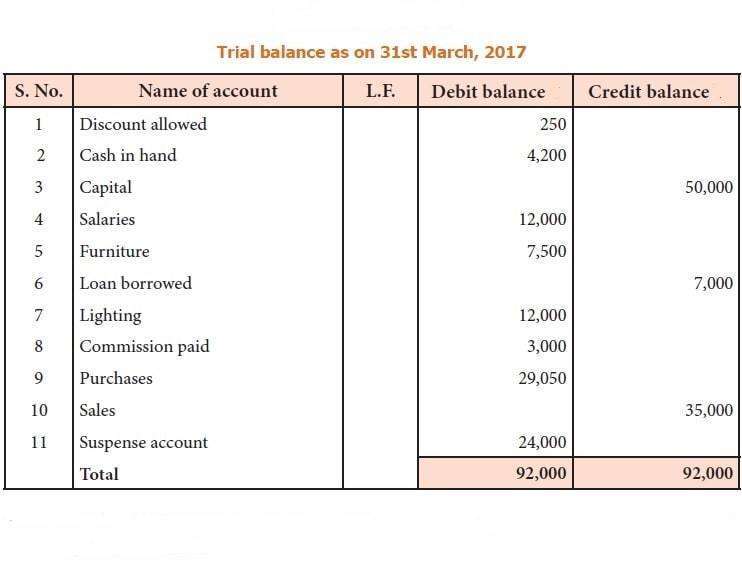

payroll accounting is the recording of all payroll transactions in your books. As a business owner, you use payroll journal entries to record payroll expenses in your books. Below is a list of the accounts you will generally need to set up on your chart of accounts to track all payroll-related activities, along with a brief description of each account.

Benefits And Paid Leave

Calculating salaries, overtime earnings, and vacation deductions. Reverse the payable entries with a debit and decrease your Cash account with a credit. You may also need to pull reports for deductions, contributions, and other benefits. Get paid in just 2-7 business days, enhance your brand and look more professional when you enable Payments by Wave. Our passion is to build a suite of products that work seamlessly together to simplify the lives of business owners like you. In self-service states Wave Payroll does not make payments or file on your behalf.

A few clicks should be all it takes to handle paperwork and payments for employees leaving your business. It’ll be a little more complex when new people join, butgood payroll softwarewill take you through the process easily. Accounting.comThis website includes state-specific information about accounting careers, degrees for prospective accountants, and available scholarships. Candidates can also locate accounting jobs across the country.

They usually hold a payroll certification as well, such as Certified Payroll Professional. When creating your own payroll accountant job description, make sure to mention these in requirements. Depending on the type of work you do and your location, you may have to meet certain payroll requirements. Restaurant owners, for instance, need to ensure their tipped employees meet minimum-wage requirements.

How To File State Taxes For Business

In that journal entry, you’re recording all of the deductions you have to take, as a business owner, from the employee’s check. For transparency and visibility, employees can find these deductions on their pay stubs. Payroll accountants must include the cost of an employer to administer health and dental benefits, give paid holidays, retirement and worker’s compensation if needed. All the information gathered here can help you budget and find out if you can expand the benefits offered to employees. A journal entry is best described as the recording of debits and credits. It generally includes an effective date, a debit amount, and a credit amount.

You may have employees who earn overtime at a rate of time-and-a-half or even double time. You may need a payroll service orpayroll software—and likely even a time tracking software—to manage that.

Post Payroll Journal Entries To The General Ledger

Summarize the wage and deduction information for each employee in a payroll register, which you can then summarize to also create a journal entry to record the payroll. This document is automatically created by all payroll software packages. One final stage in payroll accounting is to do a payroll reconciliation. A payroll reconciliation is a process you follow to ensure your payroll accounts within the general ledger accurately reflect the transactions that occurred in the payroll system. It also helps you to ensure that you are within budget throughout the year.

McGraw-Hill sites may contain links to websites owned and operated by third parties. These links are provided as supplementary materials, and for learners’ information and convenience only. McGraw-Hill has no control over and is not responsible for the content or accessibility of any linked website. Proven online content integrates seamlessly with our adaptive technology, and helps build student confidence outside of the classroom. Students, we’re committed to providing you with high-value course solutions backed by great service and a team that cares about your success.

Depending on filing requirements, you’ll need to pay the government all the taxes withheld during a given period of time (e.g., every three months, every 12 months). So if the employee in the example above worked 45 weeksduring the year and had the same paycheck every week, you would owe the government $4500 (45 weeks worked X $100 in taxes each week). The federal government requires that all businesses file a W-4 and I-9 form with the IRS for each employee.

How To Calculate Payroll Taxes?

For salaried employees, it is the flat amount for the period, such as $3,000 per month. Gross pay might be increased for both hourly and salaried employees based on applicable overtime rules.

A large number of businesses employ independent contractors whose job duties should classify them as regular employees. This is done to curb payroll tax burdens and workers compensation insurance premiums, among other reasons. The first task of payroll accounting is to collect daily, weekly and monthly records of individual employees’ time worked. Salaried employees begin at a base rate each month, and their pay can be adjusted for monetary bonuses and other additions or subtractions. Hourly employees, on the other hand, may work a different number of hours each week. Tools such as time cards and electronic time-clocks help accountants to record the exact number of hours worked by each employee. Payroll accountants must be familiar with the Federal Insurance Contributions Act, or “FICA tax”, as it is commonly referred.

The person who did that studied Payroll Accounting. That payslip is well compiled. 😂😂😂

— Xabiso Mtwana (@MtwanaXabiso) December 1, 2021

This goes back to journals 2 and 3 where you’re recording all taxes you’ve paid. These include taxes the employee is paying via their withholdings each pay period, as well as taxes the business owes. But a record of tax payments will show unemployment taxes listed alongside any taxes the employee paid.

As the name suggests, this narrow focus of accounting aims at everything that has to do with payroll – not just salaries and wages, but benefit costs and payroll taxes too. A huge benefit of payroll accounting is a better understanding of the cost of each employee, which is the key to smart growth. Whatever industry your business is in, the best accounting software can improve your understanding of your payroll accounting and its impact on your bottom line. Specialized training in payroll accounting and financial accounting enables students to maintain accounting and payroll records. Entry-level employment opportunities include positions in payroll, accounts receivable/payable, and number of trainee/internship positions.

Small business wages jumped in October – Accounting Today

Small business wages jumped in October.

Posted: Tue, 02 Nov 2021 07:00:00 GMT [source]

Payroll can also refer to the list of a company’s employees and the amount of compensation due to each of them. Payroll is a major expense for most businesses and is almost always deductible, meaning the expense can be deducted from gross income lowering the company’s taxable income. Payroll can differ from one pay period to another because of overtime, sick pay, and other variables.

Example Of Payroll Journal Entries

The payroll process can include tracking hours worked for employees, calculating pay, and distributing payments via direct deposit or check. Now that you understand the significance of payroll accounting, let’s take a quick look at what the process entails.

- This involves reducing the balance in your cash account by posting your paid liabilities as debits.

- For example, aGeorgetown University study on the economic effectsof college degrees found that candidates who hold bachelor’s degrees in accounting earn$69,000 per year on average.

- Having the right information will ensure your payroll journal entries are accurate and save you from having to do correcting entries later.

- Calculations will also depend on your state and sometimes your city or county.

In this article, we’ll give you a step-by-step guide to payroll preparation so you can be sure you’re not missing anything. Before we get to that, it’s important to discuss exactly what payroll is and what it isn’t. Spend your time and energy teaching your students, not prepping for class. You need lecture notes, PowerPoint slides, test banks, and a syllabus? An easy-to-use, practical approach that uses QuickBooks, current, realistic IRS forms, and Homework Grader automated project grading.

Tricor Group Appoints Kyungho Lee as CEO of South Korea Operations – Yahoo Finance

Tricor Group Appoints Kyungho Lee as CEO of South Korea Operations.

Posted: Wed, 01 Dec 2021 00:07:02 GMT [source]

Payroll laws will differ from state to state and city to city. There can even be significant differences based on what type of business you run. That’s why it’s crucial to do a bit of research before attempting to tackle payroll. A federal employer identification number, or EINfor short, is like a social security number for your business. You may also need a state EIN, so remember to check the business resources (Secretary Of State’s website) where you live. But within each of those categories, there exists multiple steps that you’ll need to satisfy and paperworkthat you’ll need to complete.

For example, afreelancerwould not need the same features in accounting software as a restaurant owner. Accounting software can integrate with other financial programs, including your financial accounting records. Most software can even export records to files that you can review via spreadsheet software. Once you set up your accounting software, you can program the software to issue regular payments to your employees. Consider using payroll software to simplify the process of calculating taxes and deductions. Payroll software handles the tax calculations for you, giving you more time to get back to your business.

The BLS combines salary data for accountants that specialize in tax preparation, bookkeeping, and payroll services. According toPayScale, which collects data regarding payroll accountants exclusively, the mean pay for these professionals is $53,191 per year, including additional incentive pay. Payroll accounting typically earns a place among vital functions for any business. Payroll accountants ensure timely and accurate payment of all employees and contractors.

After recording this entry, you reverse it at the beginning of the following accounting period, and then record the actual payroll expense whenever it occurs. To get started, you’ll need to set up a chart of accounts and gather reports from your payroll system. Having the right information will ensure your payroll journal entries are accurate and save you from having to do correcting entries later. When employees have performed services for the company but have not yet been paid, GAAP requires that the company recognize a liability for the amount owed to the employee. This is a common occurrence for companies that pay weekly or bi-weekly. If the end of the period does not fall on a payday, there will be funds to be paid that should be recorded as a liability. Accrued payroll expenses can be found in the current section of the company’s balance sheet.

Managing payroll can be tedious and time-consuming, but it doesn’t have to be. Run your payroll in minutes, with 100% guaranteed accuracy, and say goodbye to the unnecessary stress of payroll taxes. Track everything and connect to other Wave products such as payroll, payments, and invoicing. Integrated employee portal for access to pay stubs, tax forms, and vacation leave. John Freedman’s articles specialize in management and financial responsibility.

Author: Wyeatt Massey